Transaction Fee

The remainder of a transaction

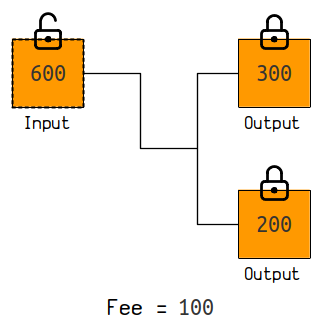

A transaction fee is the remainder of a transaction.

If you add up all the input values and subtract all the output values, the amount left over is the fee. For example:

Transaction: 82b81a39d1b6bff8366eab2297f61db7ac34b7d901f5cfc40143ca704ded980e

input 0 = 2699815 satoshis

output 0 = 1593900 satoshis

output 1 = 1060915 satoshis

fee = 45000 satoshis

As you can see there's no designated "fee" output or anything like that. The fee is just the amount of coins that you do not use up in the transaction.

Be careful, as any amount of satoshis left over in a transaction will be taken as the fee. Some people have mistakenly set large fees on their transactions by incorrectly sizing their outputs. For example, transaction cc455ae816e6cdafdb58d54e35d4f46d860047458eacf1c7405dc634631c570d had a 291.240900 BTC fee on it.

Miner Incentive

Why set a fee on a transaction?

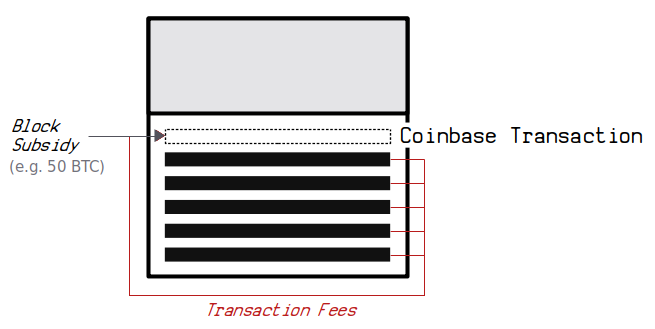

A transaction fee acts as an incentive for a miner to include your transaction in their candidate block.

This is because miners can collect all the fees from the transactions they have included their block via the coinbase transaction (if they are able to successfully mine the block on to the blockchain).

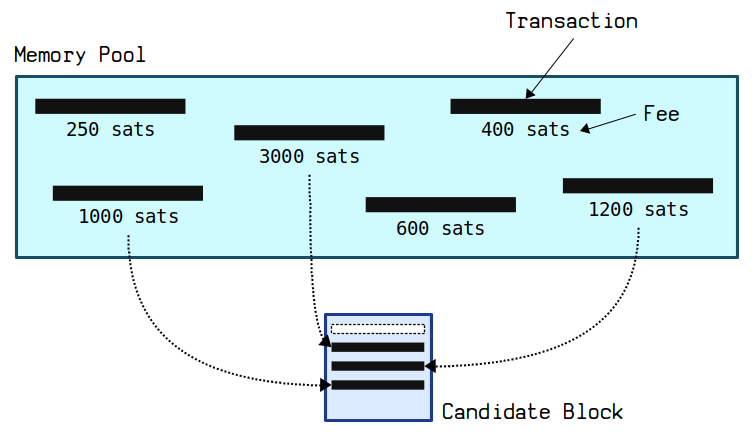

Therefore, if there are more transactions in the memory pool than can fit inside the next block, miners will choose to fill their candidate blocks with the highest-fee transaction available. This maximizes the amount of bitcoins they are able to claim if they mine the block.

Therefore, setting a fee on your transaction allows you to compete with other transactions for space in the next block. Generally speaking:

- The higher the fee, the sooner your transaction will get mined.

- The lower the fee, the longer it will take for your transaction to get mined.

If all of the transactions in the memory pool can fit in to the next block, you just can set the minimum fee on your transaction, as there is no competition to get in to the next block.

Fee Rates

How are transaction fees measured?

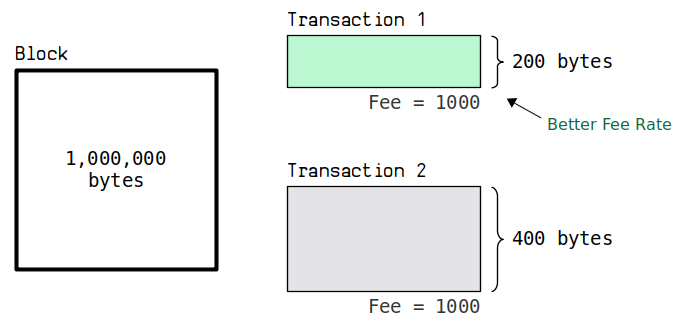

Miners want to maximize the amount of fees they can claim from their blocks. To achieve this, they measure each transaction based on how much fee they provide per the amount of space they take up in a block.

For example, a small transaction with a large fee on it is more valuable than a large transaction with the same fee on it.

So when comparing the fees on transactions, we take the size of the fee and divide it by the size of the transaction (in terms of how much space it takes up in a block). This is called the fee rate, and it allows us to compare transactions to figure out which ones are more valuable to miners than others.

- The higher the fee rate, the sooner your transaction will get mined.

- The lower the fee rate, the longer it will take for your transaction to get mined.

There are 3 different ways to measure fee rates:

- sats/byte (Deprecated)

- sats/wu (Used Internally)

- sats/vbyte (Most Common)

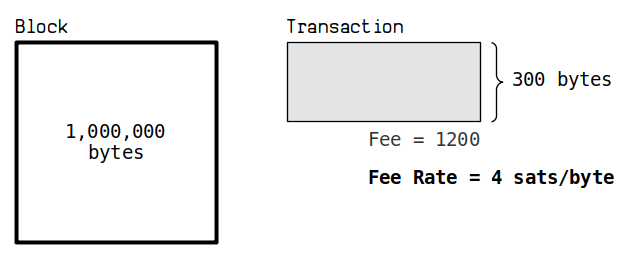

sats/byte (Deprecated)

The block limit used to be 1,000,000 bytes (1 MB).

So naturally the value of a transaction to a miner was measured as satoshis per byte, or sats/byte for short.

However, since the segregated witness upgrade (BIP 141) we now use a new weight measurement to determine how many transactions can fit inside a block…

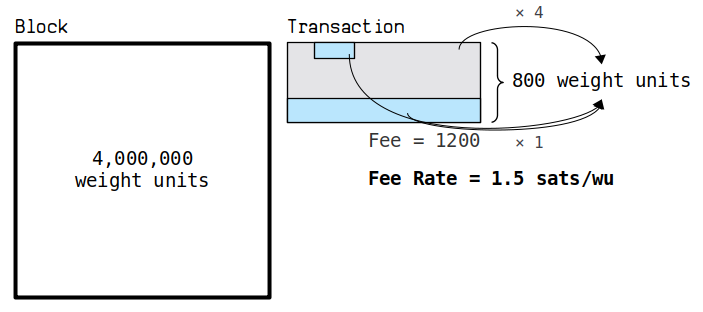

sats/wu (Used Internally)

The block limit is now 4,000,000 weight units.

The size of transactions are now measured in terms of their weight, which multiplies the size of most of the transaction data by 4. However, the new witness data gets multiplied by 1, which effectively gives it a discount relative to the other parts of the transaction.

So because blocks now have a maximum weight limit, miners measure the fee rates of transactions in satoshis per weight unit (or sats/wu for short).

However, this sats/wu is on a different scale to the old sats/byte measurement. So to keep backwards compatibility with old software that still uses sats/byte, we have one last measurement for fee rates…

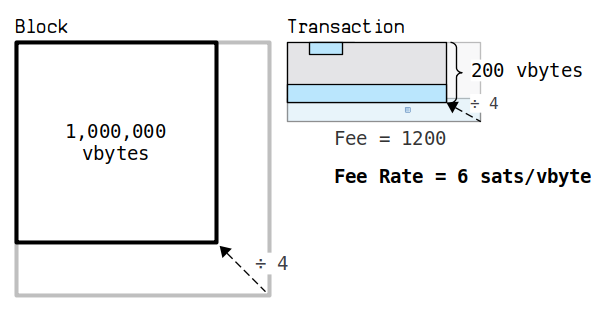

sats/vbyte (Most Common)

If you divide the block limit of 4,000,000 weight units by 4, you get a 1,000,000 virtual bytes.

And if you divide the weight of a transaction by 4 too, you get back down to pretty much using the same sats/byte measurement as before. But now every byte of witness data only counts as 0.25 of a byte, which is why we refer to this measurement as virtual bytes instead of actual bytes.

The sats/vbyte measurement means that the fee rates for newer segwit transactions are kept in line with the fee rates for legacy transactions measured in sats/byte. For example:

Legacy Transaction: a04c291e586b10f6db4d38bcba414dea2fd39d53745763d13c49026af1f09262

fee: 15977 sats

size: 223 bytes

virtual size: 223 vbytes

sats/byte: 72

sats/vbyte: 72

Segwit Transaction: 7169e93ede0096c32e4fb90f267ea29fb539324cfc3927ea9ded9066b879a1e8

fee: 10317 sats

size: 226 bytes

virtual size: 143.50 vbytes

sats/byte: 46

sats/vbyte: 72

As you can see, a legacy transaction has the same sats/byte and sats/vbyte fee rate.

So instead of using the new weight measurement for both, we bring the weight of the new segwit transactions back on to the same scale as before. This makes it easy to compare the fee rates for transactions on software that still uses sats/byte.

Internally in Bitcoin we only care about transactions in terms of weight units. But on things like blockchain explorers, we tend to use sats/vbyte instead of sats/wu.

Fee Bumping

How can you increase the fee on a transaction?

If there are lots of transaction in the memory pool and you've sent a low-fee transaction in to the network, you may end up waiting some time for transaction to get mined.

If this happens, you may want to increase the fee on your transaction while it's still sitting in the memory pool. This increases the incentive for a miner to include your transaction in their next block, which will subsequently speed up the time it takes for your transaction to get mined.

This process is called "fee bumping", and there are two methods for doing this:

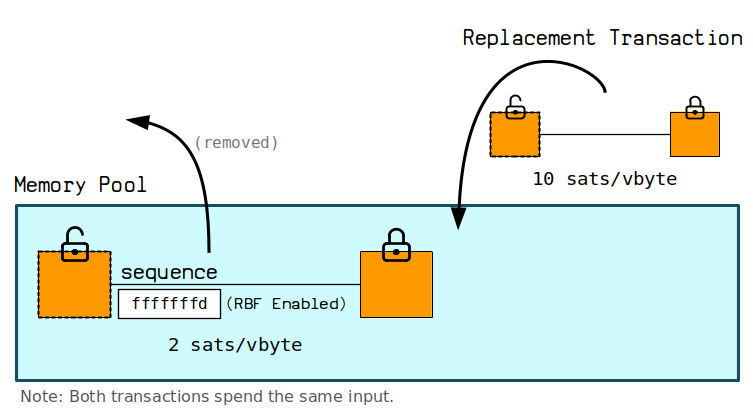

1. Replace By Fee (RBF)

This is the simplest method.

To enable this feature you just need to set one of the sequence values on your transaction to 0xFFFFFFFD or below. Then whilst this transaction is in the memory pool, you have the option to send a new version of the transaction with a higher fee on it in to the memory pool, and this higher-fee transaction will directly replace the old low-fee transaction.

And that's all there is to it. If a node or miner receives a transaction that spends the same inputs (but this time with a higher fee), they will be happy to evict the original transaction from their mempool and keep the new higher-fee transaction instead.

Replace-by-fee allows you to directly replace transactions in the memory pool.

If a current transaction in the memory pool doesn't have RBF enabled, then there is nothing you can do to replace it. You will just have to wait, or use CPFP (see below) instead.

2. Child Pays For Parent (CPFP)

This is an old technique, but it still works today.

Basically, this technique takes advantage of two facts:

- You can spend the output of a transaction whilst it's still in the memory pool.

- A miner must always include the "parents" of any transaction they include in a block (if the parents are also in the memory pool).

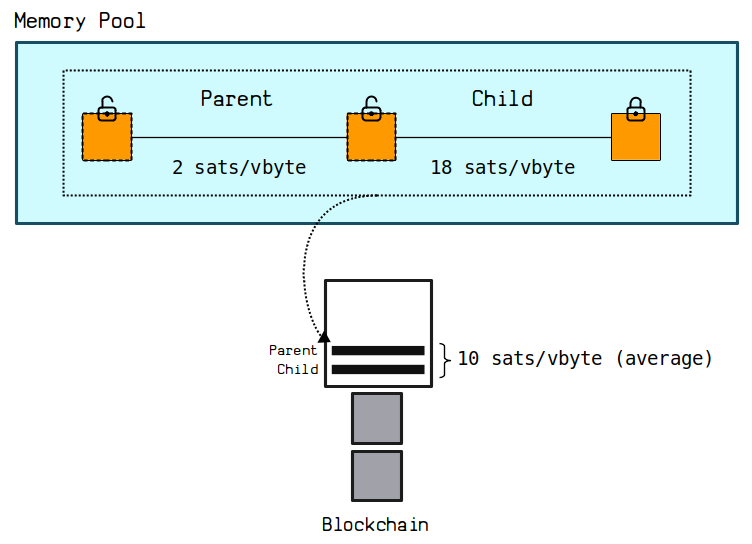

Therefore, if you've got a low-fee transaction sitting in the memory pool, you can incentivize a miner to include that transaction in their next block by spending one of its outputs in a new transaction, and putting a suitably large fee on that new transaction to make it worth including the first transaction.

So the child transaction has such a juicy fee on it that it makes it worthwhile for the miner to include the low-fee parent transaction too. Or to be more precise, the child transaction increases the average fee rate for both transactions.

There's no reason to use CPFP when you can use RBF instead. But it's a handy option to have if you've got a transaction stuck in the memory pool without RBF enabled.

Minimum Relay Fee

What's the minimum fee you can set on a transaction?

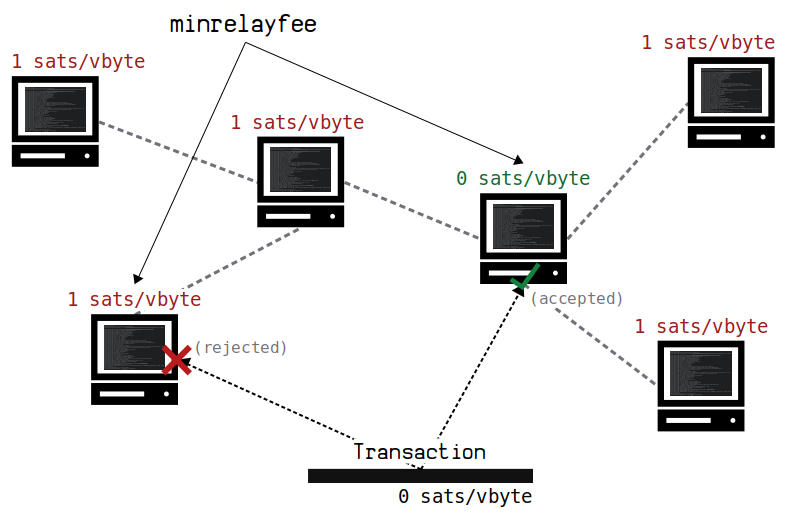

You generally want to set at least a 1 sat/vbyte fee on your transactions due to the minimum relay fee settings that nodes use.

Each node can choose their own minimum relay fee. This setting is used so that nodes do not have to waste resources by processing and holding on to low-value transactions that pay little or no fee. So it's a bit like a spam filter.

The current default minimum relay fee is 1 sat/vbyte.

However, the minimum relay fee is a policy and not a consensus rule, so it's not impossible for a zero-fee transaction to get mined in to the blockchain. It just means that any node you send a transaction to with a fee rate below this setting will not accept or relay it to other nodes.

So basically, unless you know a miner or can mine the transaction yourself, the fee you set on your transaction needs to be above the minimum relay fee of the nodes/miners you're broadcasting your transaction to.

You can find the current minimum relay fee for your node by running bitcoin-cli getmempoolinfo. You can adjust this by setting the minrelaytxfee=<amt> option in your Bitcoin Core config file.

The default minimum relay fee set by Bitcoin Core can be found in validation.h. For some reason this is defined as 1000 sat/kb instead of 1 sat/vbyte, but they both mean the same thing.

Summary

There will be transaction fees, so [miners] will have an incentive to receive and include all the transactions they can.

A transaction fee is the remainder of a bitcoin transaction, and it's used as an incentive for a miner to include your transaction in a block.

Miner's select transactions based on fee per weight unit, which is a measure of how much a miner can get in fees per the amount of space the transaction takes up in a block. This means that if there are lots of transactions being sent in to the network at the same time, there will be more competition to get transactions in to blocks, and the fee rates will increase.

If you set a low fee on your transaction and you find it's not getting mined quickly enough, you can always replace it with a higher-fee transaction using RBF. Or if RBF is not enabled, you can always use CPFP instead to incentivize a miner to include your transaction in their next block.

Lastly, if you're constructing a bitcoin transaction manually, always double-check the size of your outputs. Getting a bunch of satoshis eaten up by a miner because you miscalculated the size of your change output is not a fun way to learn how to build transactions correctly. Here are some unfortunate examples:

- cc455ae816e6cdafdb58d54e35d4f46d860047458eacf1c7405dc634631c570d: 291.2409 BTC Fee (bitcointalk thread)

- 7e8fce9686572d8308d8c40fa3cb96fdbf96c0787c147d3159c893fd560aabc7: 30 BTC Fee (Reddit post)

- 891af6431550ece772e2e2ebee13e856b971402763533babb2c49475ec260445: 7 BTC Fee (only about $85 at the time, but still unnecessary)